Investment Approach

True to our namesake ‘Vedas’ – knowledge – we embody this principle in our investment philosophy through a disciplined, research-driven approach. Our strategy follows a structured process: Research – Structure – Invest – Scale – Exit, ensuring that every investment is backed by rigorous analysis and strategic execution.

Our team actively scouts for opportunities across equity markets. Each investment idea undergoes a thorough due diligence check and in-depth research. Once the idea matures, it is shared with the investors to allow them to make their independent decision.

We are strategically committed to every investment we recommend, deploying our own capital alongside our investors—reinforcing our confidence in the opportunities we pursue.

India: Our Primary Target Market

- As India enters the list of the top five economies in the world, there has been a tactical shift amongst international investors who have started viewing India as a serious target market.

- We are on an ongoing basis understanding the sentiment of the global investors’ community towards India.

- In the last decade, India has attracted sizeable investment from large capital providers across investable segments.

- India’s equity market has become the fourth-largest globally, with a market capitalization of approximately $4.9 trillion, projected to reach $8–10 trillion by 2030. The MSCI Global Index has increased its allocation to India.

- With a profound transformation in its consumption patterns, India has become an increasingly attractive market for the global business community at large.

- We are trying to highlight the competitive advantage of India vis-à-vis other markets to global investors.

- As India cements its position as a key global investment hub, a new breed of investors is looking to allocate capital to India.

- Our job is to make the experience of international investors better while allocating capital to India.

- We thus bring various opportunities alongside our flagship product, VMF, to global investors to invest in India with ease.

Vedas Multi Manager India Fund (VMF)

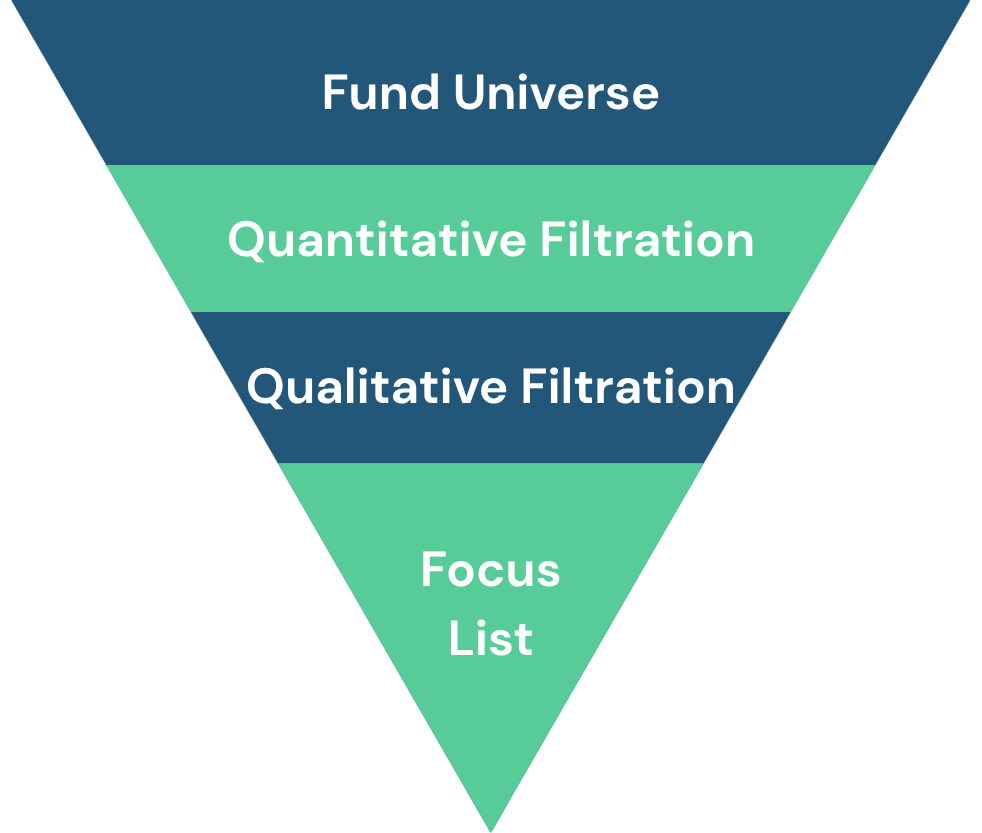

For our multi manager fund we follow a data driven fund selection:

- To identify the best portfolio managers, we employ a tech-enabled system that analyzes data from 1,000+ PMS and AIF managers using a screening model. Our selection process involves:

- Filtering funds based on key criteria, including:

- Minimum years of operational track record

- Assets under management (AUM)

- Other qualitative and quantitative parameters

- Maintaining a focus list of 20 funds, each managed with distinct strategies targeting different market segments

- Selecting 5-6 funds from this list after a comprehensive evaluation of their investment thesis, past performance, risk framework and team structure

- By combining deep market knowledge with a structured investment framework, we ensure that only the most compelling opportunities reach our investors—creating long-term value through disciplined execution.