Vedas Multi Manager India Fund (VMF)

- VMF (flagship product) is a multi-manager, long-only equity fund that provides global investors access to boutique-style, high-performing managers based in India.

- We provide seamless, dollar-denominated access to the Indian equity markets, eliminating the cumbersome regulatory processes for investors.

- Managers are selected through an extensive due diligence process for their distinct investment styles and stock-picking expertise.

- VMF is an open-ended fund with monthly subscriptions and redemptions, and its units can be held by any major custodian.

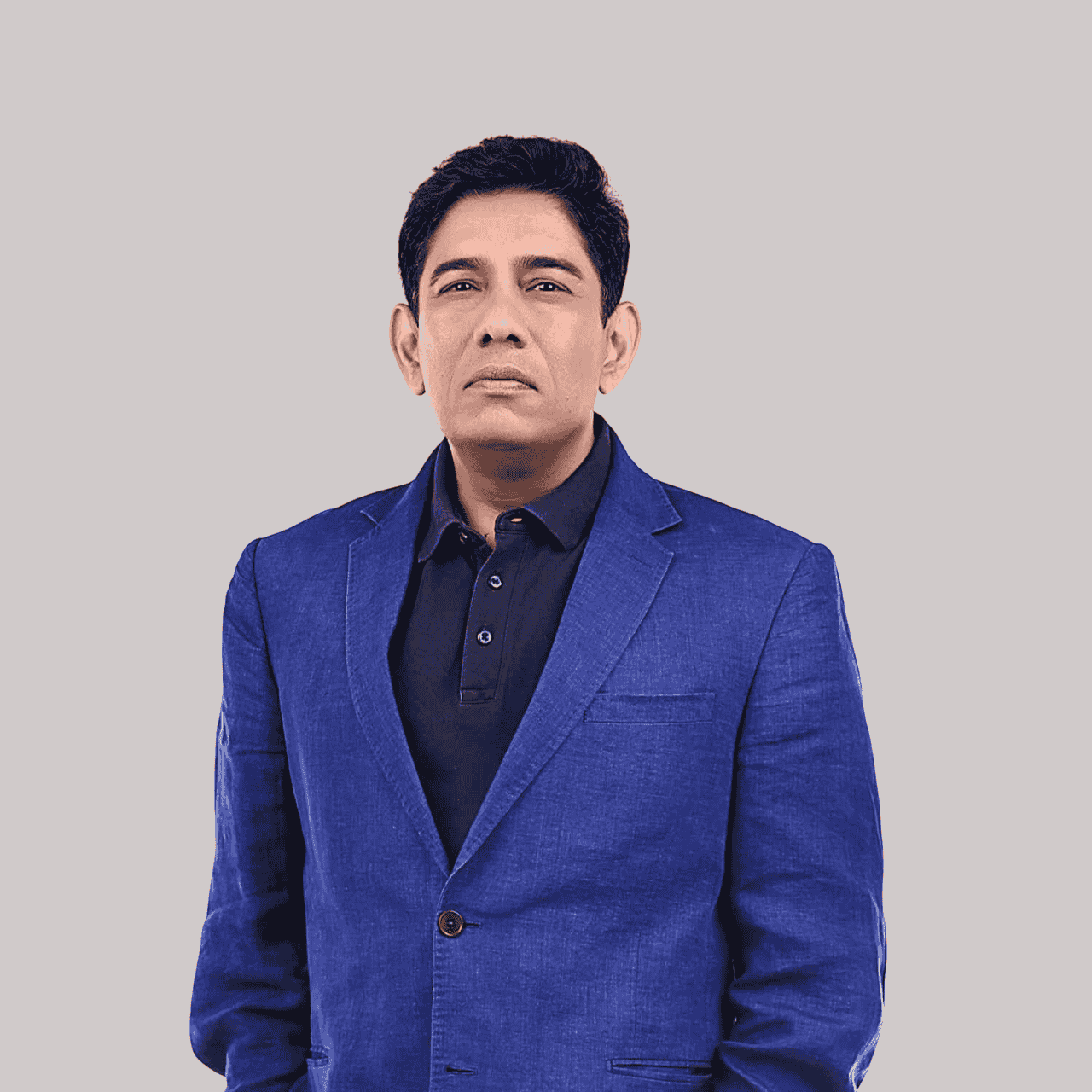

- Fund manager Mr. Rahul Bhartiya has previously won the Best Newcomer Fund award by Hedge Fund World for running a similar strategy.

SME-IPO Anchor

- Categorised as an FII, we are privileged to act as anchors in SME IPOs with secured allocation.

- Long-term relations with merchant bankers give us access to key SME IPO deals.

- We take small-sized positions in these offerings after analysing the underlying companies; primarily, these investments are from our proprietary funds.

- We are able to participate in high-growth small and medium enterprises, unlocking substantial value upon listing.

- A few of these offerings could become multibaggers in the future.

Special Situation

- Indian capital markets are burgeoning with activity across asset classes, which include equity, debt, convertibles, and others.

- Transactions are actively taking place in buyouts in stressed scenarios, debt restructuring, private credit, and other such situations.

- With our relationship with market intermediaries, we are invited from time to time to participate in such special situation transactions.

- These transactions are meant to unlock great value for the incoming investor through better financial and operational management.

- After proper analysis of such deals, if we are convinced to commit our own capital, then we share such ideas with our select investors.

Pre – IPO Ideas

- The venture capital space in India is witnessing substantial foreign capital backing Unicorn deals, with more than USD 500 billion worth of stocks still held privately.

- Equity capital markets in India are busy with activity, listing a variety of companies, supported by the strong performance in broader markets.

- With our relationships with intermediaries, we get access to PIPE deals of credible companies.

- We evaluate companies with significant growth potential and offer our clients the opportunity to invest in these companies before they go public.

- In the past, we have had access to some very credible secondaries of Unicorns which have since been listed.

- Case study: We had access to pre-IPO deals for Swiggy, OYO Rooms, and Incred Financial Services.

Single Stock Ideas

- At Vedas, we are not known for our capabilities in superior stock selection; however, from time to time, we like some ideas after going through brokerage research reports.

- Once these ideas mature, we share the same with clients to help them make their independent decision to co-invest with us.

- With our interaction with a variety of market intermediaries, we have built a list of companies we like and track them on an ongoing basis.

- Once we feel that these companies have entered a strong valuation zone, we try to take concentrated bets on some of the ideas.